This is an email I received from a friend of mine, Christy Quick. What do you think?

So I’ve been thinking so much about all the bailout programs and how it will probably take so long before the actual implementation will have an impact on the general public. I have given this a lot of thought and I have a suggestion that may help the situation. This may sound incredibly simpleton, but I want to get your thoughts on my idea. Here goes:

So what if mortgage lending institutions stopped reporting to the credit bureaus? Say they could make it retroactive that anyone that’s had a foreclosure in the past 18 months or are currently late on their mortgage payments would not be “dinged” on their credit. Think how many people would miraculously become “credit worthy” again. After all, once it is reported that they have late mortgage payments or worse yet, a posted foreclosure, they are (technical term here) effed royally – and will be for years to come. As a result, their lines of credit are reduced or cut off entirely and their interest rates got hiked higher than Paris Hilton’s mini skirt. There are countless people that stop making credit card payments (even though they have the ability to pay) simply because they know their credit score is already in the toilet. So there’s basically no incentive to keep paying on that credit card (in the short term). It’s certainly a slippery slope … but the fact of the matter is that there are so many people out there that are in good standing with their remaining creditors, but simply because of a foreclosure or pending foreclosure they have all been categorized as being not credit worthy.

As you know, this affects their ability to do almost everything! These people will have to pay higher interest rates when buying a car (if they can secure financing). They will have to pay higher interest rates on credit cards and therefore may be less likely to carry balances on them. And certainly, it affects the most basic of spending habits including buying smaller consumer goods such as TVs, clothing, holiday gifts, etc. What do you think? Do you think it is even reasonable to consider something so basic? As always, Russ, you’re such a good sounding board. All the best and Happy Thanksgiving. ~Christy

Russell has been an Associate Broker with John Hall & Associates since 1978 and ranks in the top 1% of all agents in the U.S. Most recently The Wall Street Journal recognized the Top 200 Agents in America, awarding Russell # 25 for number of units sold. Russell has been featured in many books such as, "The Billion Dollar Agent" by Steve Kantor and "The Millionaire Real Estate Agent" by Gary Keller and has often been a featured speaker for national conventions and routinely speaks at various state and local association conventions. Visit him also at nohasslelisting.com and number1homeagent.com.

Benn Rosales

November 26, 2008 at 8:18 am

I have actually predicted that a debt forgiveness will come in early to mid February, and if not then, by the end of Summer. I believe it will cover mortgage, auto, and credit cards and will for a period of time retroactively to present.

It’s been talked about already, mentioned on the campaign trail, and I hear rumors that dems are looking at it as part of a stimulus plan.

Could it, would it, should it? I don’t know, but it was a suggestion built around the Paulson plan as a consumer bail out.

Benn Rosales

November 26, 2008 at 8:23 am

PS If someone doesn’t sort out the Big Three Credit Reporting Bureaus and require better accuracy, I’m not sure how you can build an economy around credit scoring that it’s leaving out a huge segment of the consumer base.

I’m absolutely for Gov. intervention into the credit industry on a massive scale with heavy regulation- for example, if there’s a doubt, it’s not reported, if it’s really two years or more old, it’s not reported, and if the claim is incomplete, it’s absolutely not reported.

Matt Stigliano

November 26, 2008 at 8:51 am

I have to agree with Benn’s idea that the credit bureaus need a swift kick in the…well, they need fixed. The idea of credit agencies selling collections off every few years to the next agency and keeping the collection fresh on your report is damaging and downright spiteful if you ask me.

I like the idea of a “forgiveness” as it may help those consumers that got left behind. All the help in the world was too late for them, they already had lost their homes. The fact that a foreclosure can hike up interest rates on you doesn’t help you. It sends you deeper into the hole. I understand the theory of risk based credit, but the fact is it can be very damaging to someone who’s already (obviously) experiencing some problems. You just lost your home and now your credit card rate spikes? That’s not going to solve any problems.

Of course, my problem with this kind of idea is that a) it will be abused by people (if the rumor gets around that its going to happen, people will be more likely to “forget” a few payments – knowing they will be “bailed out”) and b) to be honest, not everyone deserves the help – some people made this mess for themselves, without thinking ahead, without understanding the basic principles of the need to pay your mortgage payments and need to be able to afford them in the long term, with outright lies on loan applications (sometimes at the bequest of the lenders and others involved).

Its a matter of weighing the options really. I think something needs to be done to help and although I hate to see the wrong benefits come out of it, I don’t think this is a bad idea. I’m going to give it some more thought and see where that takes me. Sometimes my gut tells me one thing quickly, but then I look at the bigger picture and see some things I may have missed.

Great post Russell, I hope to see what everyone else thinks. Could result in a very lively discussion.

Brian Brady

November 27, 2008 at 1:48 am

What about those of us who didn’t…

1- buy a home we couldn’t afford?

2- extract equity for a brand-new Hummer out of that affordable and appreciated house?

3- worked extra hard to pay off our credit card bill monthly?

4- diligently saved 10% of our paychecks?

5- spent hours poring over research reports, learning how to invest our money?

6- checked our credit for mistakes every 6 months.

Does our financial prudence count for anything or was our timing for frolicking just off?

Benn Rosales

November 27, 2008 at 7:57 am

Brian you get a 900 fico with a super cool low teaser rate so you can do it all over again…

YourMortgagePlanner

November 27, 2008 at 12:23 pm

In Basic terms your Credit Score is your Grade!

Not referencing an individual’s credit history for future credit worthiness, would essentially be the same as not referencing an individual’s education. I would most certainly want someone who didn’t pass 7 grade algebra working for NASA, I am confident Google would have no problem hiring the individual for an algorithm search position.

I was taught if you can’t afford it you don’t need it, credits purpose was not a tool to help individuals keep up with the Jones, it is a tool for leverage.

Why were at it lets release all convicted Rapist and Murders, give them a Fresh clean start!!

Missy Caulk

November 28, 2008 at 10:41 am

In the Old Testament there was a Year of Jubilee, where all debt was forgiven. It happened every 50 years, just saying…..

Christy Quick, Phoenix Realtor

December 6, 2008 at 10:45 pm

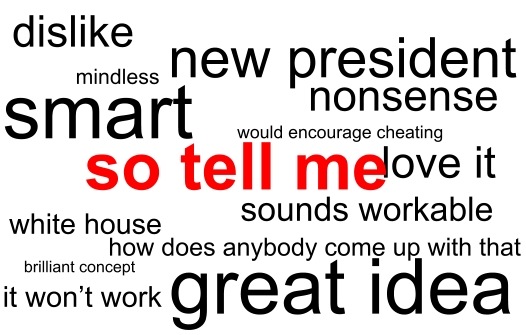

I have refrained from giving my further two cents until there was a good amount of dialogue in different areas. First, I’d like to say “really??”… having murderers and rapists in the same category as debt forgiveness. All I can say there is Wow. No offense … but wow. And Brian (I’m in awe of you actually and always seems to learn something valuable from you). But what you get in return for your diligence is a balanced economy. More people buying homes from you. The stocks that may be in your portfolio seeing positive gains again. More stores in our communities staying in business. And hasn’t our society always been based on those that are more fortunate (both financially and mentally) helping those that aren’t? Don’t get me wrong. I see a huge backlash coming mid 2009 by the people that didn’t miss payments, that didn’t overspend, that still have high 700s credit scores, etc., etc., etc. But by doing nothing (i.e., not type of credit reform) will leave at least (from what I can see) 50% of the population not credit worthy. That will continue problems with the auto industry, the electronics industry … even basic luxuries like not having to put down a security deposit when you need electricity in the apartment someone just moved into. I’m not saying my idea is necessarily the best. But I don’t see why it’s fair that just because someone let their house go into foreclosure, that now their Citibank credit card with a $7,000 balance needs to hike their interest rate to nearly 30%. I believe it’s going to take a lot of small initiatives put together to make a big bad problem smaller. Thanks for all your comments. It’s always nice to see all sides of a situation. ~C

Benn Rosales

December 7, 2008 at 8:42 am

“I believe it’s going to take a lot of small initiatives put together to make a big bad problem smaller.”

Left to the businesses themselves, this will not happen, which is why I predict that their will be something out of congress in regards to credit scoring- if not, the bar will simply be to high for the have nots or little, or even the in the middles.

The gouging has already begun…

Ken Jansen

July 28, 2009 at 5:18 pm

ROFL higher than Paris Hilton’s miniskirt…

Seriously, I think changing the credit rules would just prolong the pain in the market. We need to rip the band-aid off and get on with life. Banks need to get rid of the houses they are sitting on and let the market forces work. People would still rather live in Tampa FL or San Diego CA than Olathe KS and will still pay a pretty penny to do so. Would could always let an extra 100,000 folks into the country to increase demand for housing and increase consumer spending. 🙂