Portrait of the American home by Antonin Rémond.

Often overlooked financial option

Homeowners in a down economy often look to meet their financial obligations and rarely is a loan taken out that homeowners expect to exceed, but the benefits of doing so are great.

Overpaying a mortgage is not exactly a magical, pleasurable event, especially in a market where every penny counts, but some homeowners are going back to an era where financial responsibility, pinching pennies and the like is realistic.

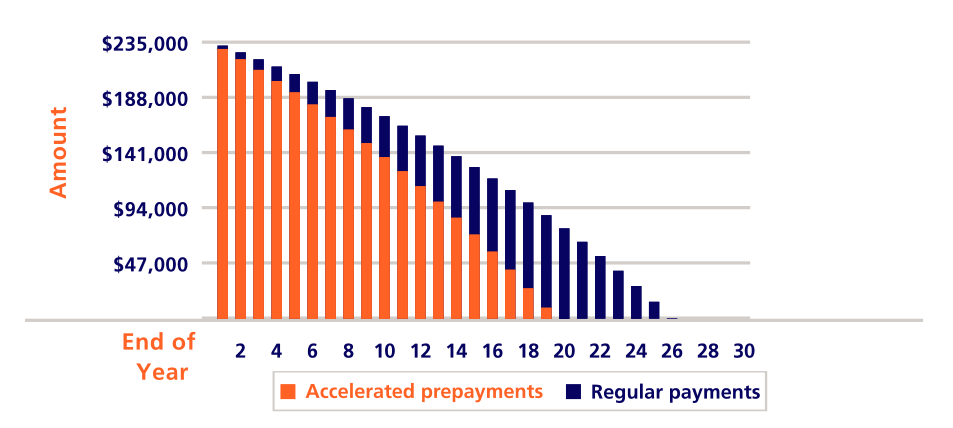

Krystal Yee at the Give Me Back My Five Bucks blog have began accelerating her own mortgage payments by paying ten percent per month and paying bi-weekly, turning her 30 year mortgage into a paid off loan in 19 years, keeping thousands of dollars of interest in her own pocket over the long haul.

Paying a 30 year loan of in 19 years:

Yee said, “My goal is to retire early, and having a mortgage 30 years from now is not going to help me. I’m not living a financially independent life if I have to rely on a bank for a mortgage. So the sooner I can become debt-free, the sooner I can think about retiring.”

Many would argue that one of the problems with modern homeownership is that Americans expect to move in three to five years, and buying a home to live in and have paid off is almost unheard of in this generation, but many homeowners are considering accelerated payments to make it happen.

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.

Bryttney Cacilhas

January 11, 2020 at 12:57 am

The word “mortgage” literally means “death pledge”. Mortality, Mortician, Mortgage all relate to death. Thats something to think about. Great post