With an impending triple dip in the real estate economy, the overall American economy should be looked at from a more macro level to understand how a recovery is even possible. As talking heads on tv claim a recovering economy, perception shifts toward optimistic from a national standpoint, but calling it a recovery is misleading.

With an impending triple dip in the real estate economy, the overall American economy should be looked at from a more macro level to understand how a recovery is even possible. As talking heads on tv claim a recovering economy, perception shifts toward optimistic from a national standpoint, but calling it a recovery is misleading.

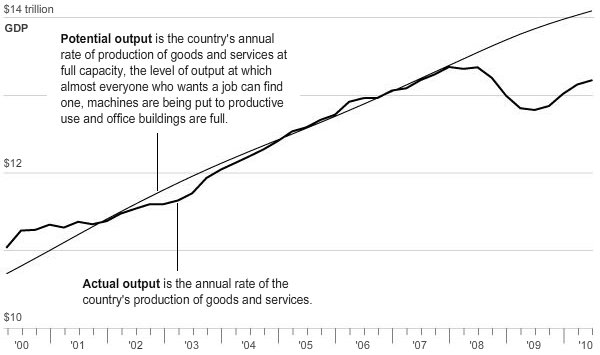

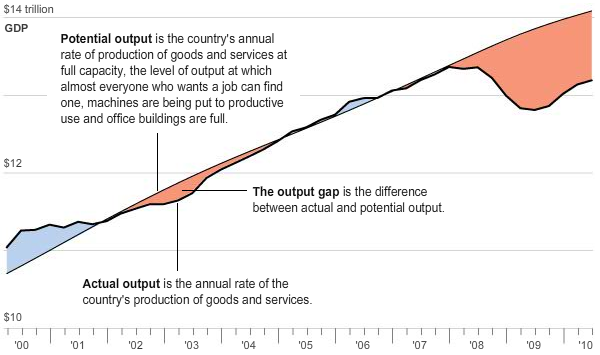

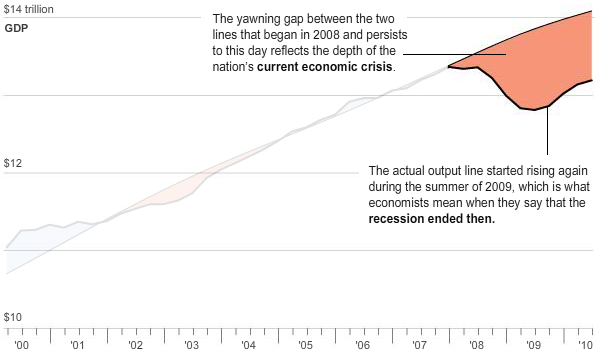

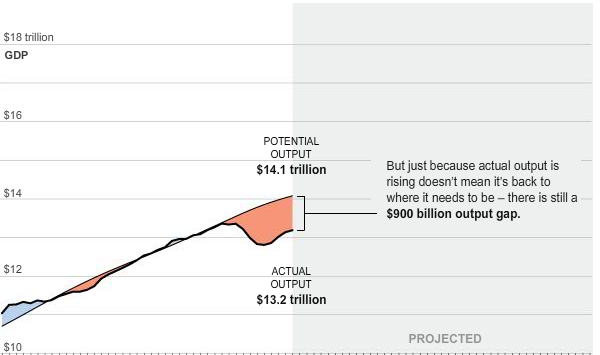

The national economy isn’t like the real estate economy where in a hyperlocal sense if people get tired of being scared, they bend over. No, the national economy weighs heavily on overall production (not to mention geopolitical moving parts) and news analysts can say “recovery” all they want, but look at all of these charts from the Washington Post (*take special note on the chart that is highlighted) and tell me if you think we’ve recovered:

As a Realtor, you’re expected to have a grasp on the overall economy, not just your local corner of the woods. If everyone saw the mortgage crisis and now the foreclosure crisis coming, it wouldn’t have reached crisis status. Why did so many not see it? Because so many people are devoted to their tiny neck of the woods (as they should be) and couldn’t see an overall picture. It’s an unfair reality that agents on the ground are supposed to know every nook and cranny of a street yet be national economic forecasters as well.

It boils down to what AG author Fred Glick has been screaming from the mountaintops here and on CNBC for two plus years now… the overall picture currently is that employment rates must come up and when they do, that alone will spell a recovery. No jobs = no loans = no house buying = no Realtor pay day.

To see the charts animated, visit the Washington Post.

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Ken Brand

October 18, 2010 at 3:08 pm

For the first time, I’m starting to hear some of those talking bobble heads you mentioned talk about the idea that perhaps the unemployment is really due to bad politics and policy. Maybe it’s structural, and the reality is, as our economy moved from labor and manufacturing, into technology, those jobs are gone for ever, and those workers aren’t going to be become IT wizards, or the next Facebook, they’re unemployable. More bad news, but it makes sense. Your charts are helpful as well. Anyway you cut, if you’re a real estate agent, you have to figure out how to make your way. Damn, 2020 huh? Crap, I don’t know if I’ll live that long?

BawldGuy

October 18, 2010 at 3:40 pm

As far as CNBC goes, Larry Kudlow is the Lone Ranger out there talkin’ about a job driven recovery, in order for it to be real. Fred’s been on the money all along. So are you, Lani.

It’s about the jobs, stoopid.

Ruthmarie Hicks

October 18, 2010 at 6:11 pm

Hi Lani,

I love the graphs. But I think the problem lies deeper than this particular recession. I note that the gap between potential and actual output starts to grow a the tail end of 2007 and the start of 2008. But I think that’s deceiving. The trend that created the crisis began long before the symptoms manifested.

What we were seeing for years was an erosion of our manufacturing and intellectual base. This has resulted from about a 25 year period of assault on salaries and safety nets for anyone who didn’t hold the gold.

This resulted in a serious narrowing of career options for those seeking a reasonable level of financial security. I’m not even discussing a lifestyle that involves multiple homes, private jets and a high life. I’m talking basic financial security with a safety net. It’s not just the line worker in a GM plant that has been marginalized. Its computer scientists, engineers, programmers, mathematicians, even physicians – in other words the creative and intellectual minds that drive innovation in this country (the vital STEM fields). These professionals have been under financial assault right along with the rank and file worker.

So the suits and business people sucked innovation right out of Gen X and Gen Y and then we wonder why there is no new innovation to drive new growth? Now that works really well, doesn’t it?

Alex Dsouza

October 19, 2010 at 3:48 am

The problem lies in a deep root of people’s sentiment in investing money on real estate. Many people have got bad experience after sub-prime lending crisis. Perhaps, Govt should do to lift public sentiments rather than injecting a big chunk of money into the economy. Many economists fear of a further deep crisis. Lets see how things will work in future.

Joe Loomer

October 19, 2010 at 6:45 am

Surprised none of the usual suspects threw out the illegals flag, and its impact on U.S. workers. Ooops, am I supposed to call them “undocumented?” My bust. Might be a few jobs for the taking if a few of them went back home.

Navy Chief, Navy Pride

Ruthmarie Hicks

October 19, 2010 at 7:14 am

Actually, its the ones who are here legally that are suppressing salaries at an alarming rate. How do you get an American scientist with a doctorate to work for under $40k a year in NYC (that’s poverty wages in NY) for 70 hours a week? Force him/her to compete with Chinese and Indian nationals desperate for a green card here on H1-B visas. The result: After 25 years – 90% of the Americans are GONE – the ones that remain will die in poverty. My field was complete devastated by that system. HEY! There are people HERE who know how to do the work. The notion that Americans can’t do the work is a myth.

You need much TOUGHER screening for H1-B visa requests.

Sam in Austin

October 20, 2010 at 4:06 pm

Very useful information and the graphs were an excellent resource. Nice conversation you got going as well.