The Federal Deposit Insurance Corporation expects more banks to fail in 2010, increasing the operating budget 35% to $4 billion dollars. Over 1,600 new staff members will also be added to the payroll. Luckily the FDIC sees this as more of a short-term problem since only 84 of these are permanent positions.

The Federal Deposit Insurance Corporation expects more banks to fail in 2010, increasing the operating budget 35% to $4 billion dollars. Over 1,600 new staff members will also be added to the payroll. Luckily the FDIC sees this as more of a short-term problem since only 84 of these are permanent positions.

133 banks have already failed this year, and there’s no evidence to suggest the 134th is far away. The FDIC keeps a tight lip on the health of the nation’s 8,300 banks. So a website run by MSNBC and American University helps to check the status of your your bank. BankTracker for banks or credit unions offers a large US map, making them easy to find. Or just type the name in their search bar and look at the troubled-asset ratio. The BankTracker site says:

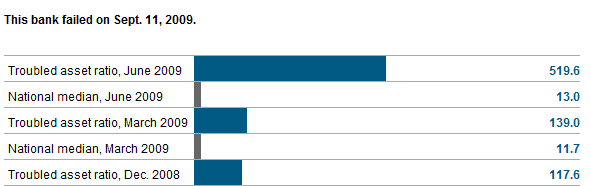

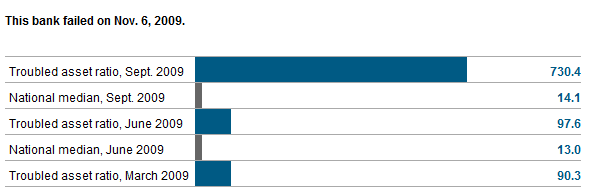

While it is not an official FDIC statistic, nor is it intended as a definitive predictor of the likelihood of bank failure, the troubled asset ratio apparently is a strong indicator of severe stress inside a bank because it shows the bank’s ability to withstand loan losses. Of the 92 banks that have failed so far this year, 84 had troubled asset ratios of 100 percent or greater in the final quarter they reported data before they closed.

Look at these recently failed Minnesota banks and notice how the asset ratio is well above 100%

MSNBC has also compiled a list of banks with the highest levels of troubled loans. If your bank or credit union’s troubled-asset ratio number is near 100, there’s no need to immediately withdraw your money unless you have over $250,000 in your account.

As the son of two music teachers, Ben spent his first 21 years trying to make a living with his slightly above average trumpet playing. After no return calls from Dizzy Gillespie and then a failed attempt at becoming a fly girl on "In Living Color," he switched gears and finally found his nichè in real estate. He's a Minnesota appraiser and also a Realtor with his better half, Stacia. Labeled “one to watch” from an anonymous source (thanks mom), Ben is smart, good looking, athletic and a rock star inside his own head. He also never passes up a chance to write his own bio. Find him online at twitter or selling Stillwater Real Estate.