May home price data

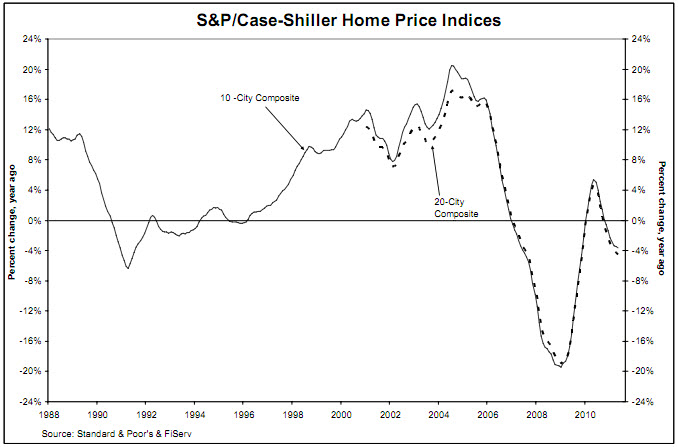

Home prices are often an indicator of the overall health of the real estate sector and with S&P/Case-Shiller releasing data that shows May marks the second month in a row of increasing home prices for their 10 and 20-city composites, there is a glimmer of hope in some analysts’ eyes for housing.

The S&P/Case-Shiller home price index rose roughly one percent in each index with 16 of the 20 cities studied posting rising home prices, although Tampa, Las Vegas, and Detroit declined and Phoenix remained unchanged.

As other indexes consistently show, Washington D.C. was the only city with an increase year over year, up 1.3% while Minneapolis performed the worst, posting an 11.7% drop in home prices.

S&P/Case-Shiller analyst weighs in

“We see some seasonal improvements with May’s data,” said David M. Blitzer, Chairman of the Index Committee at S&P Indices in a statement.

“This is a seasonal period of stronger demand for houses, so monthly price increases are to be expected and were seen in 16 of the 20 cities. The exceptions where prices fell were Detroit, Las Vegas and Tampa. However, 19 of 20 cities saw prices drop over the last 12 months. The concern is that much of the monthly gains are only seasonal,” Blitzer noted.

The Chairman continued, “May’s report showed unusually large revisions across some of the MSAs. In particular, Detroit, New York, Tampa and Washington DC all saw above normal revisions. Our sales pairs data indicate that these markets reported a lot more sales from prior months, which caused the revisions. The lag in reporting home sales in these markets has increased over the past few months. Also, when sales volumes are relatively low, as is the case right now, revisions are more noticeable.”

CalculatedRisk weighs in

The CalculatedRiskBlog.com takes a different view, noting that S&P/Case-Shiller releases non-seasonally adjusted numbers but when looking at seasonally adjusted S&P data, the 10-city index is down 3.6% compared to May 2010 and the 20-city index is down 4.5%.

Graphing housing prices

Click to enlarge the non-seasonally adjusted S&P home price indices:

Click to enlarge the seasonally adjusted S&P home price indices across cities:

Tara Steele is the News Director at The American Genius, covering entrepreneur, real estate, technology news and everything in between. If you'd like to reach Tara with a question, comment, press release or hot news tip, simply click the link below.

Kathleen Cosner

July 27, 2011 at 5:21 am

What I don't like about the S&P is that it's limited to 20 cities, so it's misleading. If more MLS's reported nationaly, or even county-wide, we would get a much better picture as to what's going on at local levels.