Wobbling pending home sales

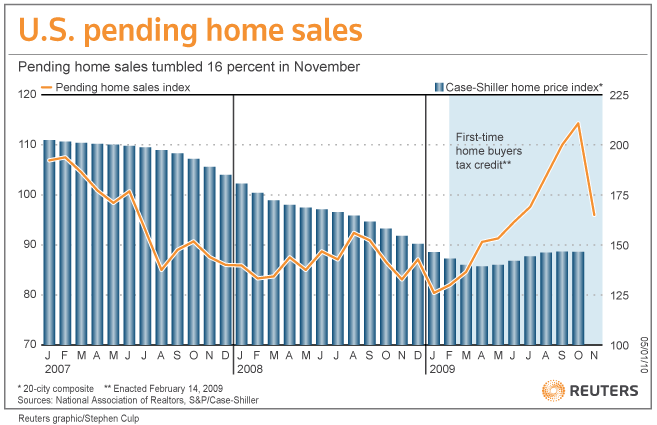

After nine months of pending home sales inching up, November’s stats released today by the National Association of Realtors reveals that the pending home sales index fell 16% in November as seen by the recent nosedive in the chart above, putting us back roughly to the level we were at in November of 2008 (which won’t exactly go down in history as a good month for the real estate industry).

Just last month, NAR Chief Economist Yun said about the ninth month of rising pending home sales, “still, as inventories continue to decline and balance is gradually restored between buyers and sellers, we should reach self-sustaining housing conditions and firming home prices in most areas around the middle of 2010. That would mean broad wealth stabilization for the vast number of middle-class families.”

Just one month later, Yun said, “it will be at least early spring before we see notable gains in sales activity as home buyers respond to the recently extended and expanded tax credit.” Yun noted, “We expect another surge in the spring as more home buyers take advantage of affordable housing conditions before the tax credit expires.”

After a great deal of money was poured into the loud campaign urging buyers to rush to beat the November 1st tax credit deadline, the credit was extended, leaving many agents to feel as if they cried wolf and lost ground in consumer trust. The 16% dip is easily pointed to as a result of the perceived November 1st tax credit deadline, yet many consumers we’ve spoken with didn’t know the credit has been extended.

Now we’re left to wonder if a stable market will come in mid 2010 as stated by Yun in December or will stabilization occur much later as many consumers are not aware the tax credit was extended and no longer have an impending emergency reason to buy and are sitting still waiting for a reason?

Some parts of the nation are doing much better this year- the West declined 2.7% but is up 21.4% over November 2009 while the Northeast dropped a heartbreaking 25.7%, dipping much lower than the national 16% drop.

How do we get out of this mess?

We got excited at the chart above climbing and climbing, just to experience yet another slap in the face to the real estate industry. Today, it was announced that the U.S. dollar fell and the 16% drop in pending home sales didn’t help and if any hint of job growth comes around, the Federal Reserve will likely raise interest rates sooner than later to help the value of the dollar.

The weaker housing data backed comments by Federal Reserve Governor Elizabeth Duke on Monday that there were still strong headwinds in the housing market and the Fed needs to keep interest rates “exceptionally low” for an “extended period.”

With telling news of pending home sales down as well as news of construction spending dipping, The Fed will have to get involved to change the course of this mammoth ship and the Government may have to continue backing the market with tax incentives.

“Sales should rebound going forward. Nevertheless, this report suggests that the recent strength of housing demand is still far from becoming self-sustaining and that the housing market remains overly dependent on government support,” Anna Piretti, an economist at BNP Paribas in New York told Reuters.

Lani is the COO and News Director at The American Genius, has co-authored a book, co-founded BASHH, Austin Digital Jobs, Remote Digital Jobs, and is a seasoned business writer and editorialist with a penchant for the irreverent.

Sal Antsipenka

January 6, 2010 at 1:14 am

We are quite fortunate here in Naples Florida. Pending sales are still inching up. Condo foreclosure market is naturally the most active. Homes between $250K and $400K sell actively as well. We are experiencing a surge of international home buyers and investors snatching up cheap condo deals. Unfortunately middle price range and luxury homes have a lot of room to go down and they definitely will quite soon.

Joe Loomer

January 6, 2010 at 6:33 am

Looks to me like the sales dropped every November on the chart. Isn’t this cyclical winter sales at play? Less people are moving in the winter and it’s hand-wringing time? The credit extension didn’t work? C’mon folks, it’s the WINTER – chill out (no pun intended).

Locally, detached single family sales (detached) went up 60% in November (over November 2008). Many of these folks contracted in September and October with the idea the tax credit was going to end. December preliminary figures have us in Augusta back to reality and about the same as ’08. Less urgency, AND it’s the winter.

I don’t think it’s a surprise to anyone that the whole recovery is too dependent on the government, not just the housing sector.

Navy Chief, Navy Pride

Mike

January 6, 2010 at 7:27 am

Pending sales could also be down due to lack of inventory. Here in Loudoun County (Northern VA) inventory is 1/3 of where it was in Nov 2007. Buyers are very frustrated here, due to losing out on a multiple offer situation. $400k and down is hot.

Eric Holmes

January 6, 2010 at 12:10 pm

The Dallas – Ft. Worth market uses as appointment service (www.showings.com) to schedule 90+% (estimation) of the showings in this market. In addition, they keep the showing data based on Zip Code and MLS Zone. I’ve started to compare the showing data on a year to year basis of certain Zip Codes to get an idea of market cycles and market health. Over the past four years the showings have remained fairly consistent in that the showings begin a steady decline around mid-September and they drop rapidly after Thanksgiving. It only makes sense that an increase/decrease in showings will predict the number of sales provided there aren’t huge discrepancies in inventory on a year to year basis.

Personally, I don’t see the 2010 being markedly improved over 2008 or 2009, except with additional interest of people trying to transition from rentals into homes to take advantage of the interest rates and the tax incentives.

Courtney Donato-Griffiths

January 6, 2010 at 1:31 pm

I was also reviewing statistics yesterday for Montgomery County and Metro Area. Here is the real (or my interpretation of the real) story.

Inventory is down…..way down. 2003 levels down and pending sales are also down, but there is nearly full absorption of all new inventory. Pending sales will drop seasonally in December anyways and combine this with the fact that there is less to sell, and I would nto be concerned.

I am having more trouble finding homes for my buyers than selling my listings.

Here’s to a happy spring market, which starts Jan 1 and ends May 1.

Ruthmarie Hicks

January 6, 2010 at 2:19 pm

Caveat to everything I say: I live in a high-priced area. The tax credit didn’t do as much for us as in other parts of the country.

1. We had strong sales through the end of the year.

2. Inventories are down – which could slow things down a bit and put some upward pressure on prices.

3. It gets COLD here. Buyers don’t like trudging through the snow. People stop looking as much during Dec/Jan. Listings start to pick up in late Feb.

4. BUT there are some entry level clients going out looking. The extension does have something to do with that.

I think the impact varies throughout the country. Each community is different.

Justin Boland

January 8, 2010 at 6:18 pm

“…if any hint of job growth comes around, the Federal Reserve will likely raise interest rates sooner than later to help the value of the dollar.”

I’m curious: our current national situation has us deeper in the hole every single month, as gov accounting tricks magically wipe hundreds of thousands of unemployed people off the “Unemployement Statistics.” If we start seeing incremental gains in “new jobs,” do you think that would be enough for the Fed, despite the fact those numbers aren’t reflecting any kind of real-world, actual recovery?

I realize that I’m basically asking about the mind of God when I ask you to second guess a secretive organization like the Fed, but I’m curious what you think since you know more than myself.